CA DE 927B 2019-2025 free printable template

Show details

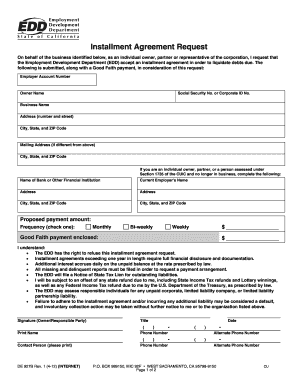

Signature Owner/Responsible Party Title Print Name Phone Number Alternate Phone Number Contact Person please print DE 927B Rev. 2 3-19 INTERNET Date PO BOX 989150 MIC 92F WEST SACRAMENTO CA 95798-9150 Page 1 of 2 CU INSTALLMENT AGREEMENT REQUEST DE 927B INSTRUCTIONS Complete all requested information. Write N/A not applicable in those areas that do not apply to your business. If the form is incomplete or unsigned we will not be able to consider your request for an installment agreement....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign agreement edd number form

Edit your de 1446 pdf download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your edd installment agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing edd 2025 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit edd tax form 2025. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA DE 927B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out edd como llenar la forma de disability

How to fill out CA DE 927B

01

Begin by downloading the CA DE 927B form from the official Employment Development Department (EDD) website.

02

Fill in your personal information at the top, including your name, address, and Social Security number.

03

Provide the details of your employment situation for the reporting period, such as your job title and the name of your employer.

04

Indicate the total number of hours worked and the amount earned during the reporting period.

05

Review the form to ensure accuracy and completeness to avoid any delays.

06

Sign and date the form at the bottom before submitting it to the EDD.

Who needs CA DE 927B?

01

Any individual reporting earnings who is receiving unemployment benefits in California should complete the CA DE 927B form.

02

This form is necessary for those who need to report income as part of their eligibility requirements for unemployment insurance.

Fill

de 1446 form printable

: Try Risk Free

People Also Ask about apkmodget

What is California individual state tax?

Single or married filing separately Tax rateTaxable income bracketTax owed1%$0 to $10,099.1% of taxable income.2%$10,100 to $23,942.$100.99 plus 2% of the amount over $10,099.4%$23,943 to $37,788.$377.85 plus 4% of the amount over $23,942.6%$37,789 to $52,455.$931.69 plus 6% of the amount over $37,788.5 more rows • Apr 20, 2023

How long is the FTB installment agreement?

Business. If you can't pay your tax bill in 90 days and want to get on a payment plan, you can apply for an installment agreement. It may take up to 60 days to process your request. Typically, you will have up to 12 months to pay off your balance.

Who must file a California individual tax return?

Minimum Income to File Taxes in California IF your filing status is . . .AND at the end of 2022 you were* . . .THEN file a return if your gross income** was at least . . .Married filing separatelyany age$5Head of householdunder 65 65 or older$19,400 $21,150Qualifying widow(er)under 65 65 or older$25,900 $27,3002 more rows

What is CA Form 3567?

Installment Agreement Request (3567) – Franchise Tax Board Government Form in California – Formalu. Locations.

What is the STD 213 used for?

The STD. 213 is used by departments with approved IT purchasing authority and the DGS/PD. The contract must be strictly for IT services or in instances where the IT goods being purchased are subordinate to the value of the IT service.

What is California individual forms?

The most common California income tax form is the CA 540. This form is used by California residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get franchise tax bo payments?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific edd withholding form how to fill out and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for the CA DE 927B in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your CA DE 927B in seconds.

Can I create an eSignature for the CA DE 927B in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your CA DE 927B and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is CA DE 927B?

CA DE 927B is a form used by employers in California to report employment and wage information to the Employment Development Department (EDD).

Who is required to file CA DE 927B?

Employers in California who have employees and are required to report wage information to the EDD must file CA DE 927B.

How to fill out CA DE 927B?

To fill out CA DE 927B, employers must provide information such as the business name, address, and the total wages paid to employees during the reporting period.

What is the purpose of CA DE 927B?

The purpose of CA DE 927B is to report wages and employment information to the EDD, which is used for unemployment insurance and other state programs.

What information must be reported on CA DE 927B?

The information that must be reported on CA DE 927B includes the total amount of wages paid, employee details, and any applicable deductions.

Fill out your CA DE 927B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA DE 927b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.