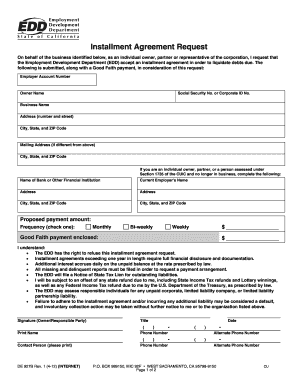

CA DE 927B 2019-2024 free printable template

Show details

Signature Owner/Responsible Party Title Print Name Phone Number Alternate Phone Number Contact Person please print DE 927B Rev. 2 3-19 INTERNET Date PO BOX 989150 MIC 92F WEST SACRAMENTO CA 95798-9150 Page 1 of 2 CU INSTALLMENT AGREEMENT REQUEST DE 927B INSTRUCTIONS Complete all requested information. Write N/A not applicable in those areas that do not apply to your business. If the form is incomplete or unsigned we will not be able to consider your request for an installment agreement....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your owner 927b make 2019-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your owner 927b make 2019-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing owner 927b make online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit installment agreement financial form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

CA DE 927B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out owner 927b make 2019-2024

How to fill out installment agreement financial:

01

Gather required information: Before starting to fill out the installment agreement, gather all the necessary information such as your personal details, contact information, social security number, and any relevant financial documents.

02

Download or request the form: You can usually find the installment agreement form on the website of the relevant financial institution or organization. If it is not readily available, you may need to request a copy either online or by visiting their office in person.

03

Read the instructions carefully: Make sure to carefully read the instructions that come with the installment agreement form. This will provide important information on how to properly fill out the form and what relevant documents or supporting information may be required.

04

Provide personal information: Start filling out the form by providing your personal information. This might include your full name, address, contact details, social security number, and any other requested personal identifiers.

05

Fill in financial details: Next, you will need to provide detailed financial information. This may include your income, expenses, assets, liabilities, and any other relevant financial details that are required for the agreement.

06

Be accurate and honest: It's crucial to provide accurate and honest information while filling out the installment agreement. Any false or misleading information may lead to legal consequences, so ensure that all the information provided is true to the best of your knowledge.

07

Attach supporting documents: Depending on the requirements of the installment agreement, you may need to attach supporting documents such as bank statements, tax returns, pay stubs, or any other financial records that can substantiate the information you have provided.

08

Review and sign: Once you have filled out the installment agreement form, carefully review all the information provided. Double-check for any errors or missing details. Then, sign the form as required.

09

Submit the agreement: After thoroughly reviewing the agreement and ensuring all information is accurate, submit the form to the appropriate party. This may involve mailing it, submitting it online, or visiting the relevant office in person.

Who needs an installment agreement financial:

01

Individuals with outstanding debts: Those who have outstanding debts such as credit card bills, loans, or taxes may need an installment agreement to establish a structured plan to repay their obligations over time.

02

Small business owners: Small business owners who are facing financial difficulties or need to repay business-related debts may utilize an installment agreement to manage their payment schedules.

03

People facing financial hardship: Individuals experiencing financial hardship may require an installment agreement to negotiate lower monthly payments or extend the repayment period to make it more manageable.

04

Those with unpredictable income: Individuals with irregular or unpredictable income, such as freelancers or seasonal workers, may find an installment agreement helpful as it allows for flexibility in payment structures.

05

Individuals in legal disputes: People involved in legal disputes or lawsuits that require monetary settlements may opt for an installment agreement to fulfill their payment obligations.

Fill installment agreement address : Try Risk Free

People Also Ask about owner 927b make

What is California individual state tax?

How long is the FTB installment agreement?

Who must file a California individual tax return?

What is CA Form 3567?

What is the STD 213 used for?

What is California individual forms?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is installment agreement financial?

An installment agreement is a payment plan that allows you to pay off your debt in regular, scheduled payments over a period of time. It’s an agreement between you and the creditor or collection agency that allows you to pay off the debt in full, but in smaller, more manageable payments. Depending on the creditor, you may be able to make payments via check, debit card, or automatic withdrawal from your bank account.

Who is required to file installment agreement financial?

Anyone who owes more than $10,000 in taxes to the IRS is required to file for an installment agreement. This agreement allows taxpayers to pay what they owe back to the IRS in monthly payments over a period of time.

How to fill out installment agreement financial?

1. Gather the necessary documents. Before you can fill out an installment agreement financial form, you will need to have a few documents on hand, such as a copy of your tax return or notice, proof of income, and other financial documents.

2. Fill out the form. The installment agreement financial form is fairly straightforward and should be filled out following the instructions provided. Be sure to fill in all the required fields, such as the taxpayer's name, address, Social Security number, and the amount owed.

3. Provide proof of income. You will need to provide proof of income to the Internal Revenue Service (IRS) in order to prove that you have the ability to make the payments as outlined in the installment agreement. This can be done by providing copies of recent pay stubs, bank statements, or other documents that show your income.

4. Submit the form. Once you have filled out the form and provided all the necessary documents, you can submit it to the IRS. You can either mail your form or submit it online. If you submit it online, you will need to create an online account with the IRS.

5. Agree to the terms. Once your installment agreement is approved, you will need to agree to the terms, such as making the payments on time and in full. Make sure you read and understand all the terms before you agree to them.

What is the purpose of installment agreement financial?

Installment agreement financial is a type of financial agreement in which a borrower agrees to repay a loan amount in multiple payments over a period of time. This is a good option for those who need access to funds but do not have the upfront cash to pay for a large purchase. It also helps borrowers avoid paying high interest rates associated with credit cards.

When is the deadline to file installment agreement financial in 2023?

The deadline to file an installment agreement with the IRS for tax year 2023 is April 15, 2024.

What is the penalty for the late filing of installment agreement financial?

The penalty for late filing of installment agreement financial statements is a minimum fine of $100. Depending on the amount of the debt, the total penalty can be up to 25% of the total amount owed.

What information must be reported on installment agreement financial?

When reporting on an installment agreement financial, the following information typically needs to be included:

1. Basic Information: The name, address, and contact details of the borrower and the lender.

2. Loan Details: The loan amount, interest rate, repayment term, and any applicable fees or charges associated with the installment agreement.

3. Payment Schedule: The agreed-upon repayment schedule, indicating the due dates, frequency (e.g., monthly, quarterly), and payment amounts for each installment.

4. Outstanding Balance: The outstanding balance of the loan at the reporting date.

5. Payment History: A record of all payments made by the borrower, including the date, amount, and any additional remarks or notes regarding the payment (e.g., late payments, partial payments).

6. Interest Accrued: The amount of interest that has accrued on the loan since the last reporting date.

7. Late Fees or Penalties: Any additional charges imposed on the borrower for late payments or other breaches of the agreement.

8. Default or Delinquency: If the borrower has defaulted or become delinquent on the installment agreement, it should be clearly mentioned along with any actions taken by the lender.

9. Collateral or Security: If the installment agreement is secured by any assets or collateral, details regarding the nature and value of those assets should be reported.

10. Other Terms and Conditions: Any other relevant terms and conditions of the installment agreement, such as prepayment options, early termination penalties, or renegotiation clauses, should be included.

It's important to note that specific reporting requirements may vary depending on the jurisdiction or the type of loan agreement.

How can I get owner 927b make?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific installment agreement financial form and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for the edd request in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your payment 927b sample in seconds.

Can I create an eSignature for the property agreement form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your financial 927b create form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your owner 927b make 2019-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Edd Request is not the form you're looking for?Search for another form here.

Keywords relevant to installment request edd form

Related to installment edd

If you believe that this page should be taken down, please follow our DMCA take down process

here

.